Who We Are

Unicap International Investment Consultant Finance Ltd is a highly diversified investment management company. We are distinguished by our Kuwait -centric investment strategy, which is favorably leveraged by the local know how, experience and extensive business networks of our team.

Unicap International Investment Consultant Finance Ltd follows a disciplined investment approach that hinges on defining strategic initiatives, sharp implementation of strategy, supporting talented management, and providing required growth capital to drive growth.

Vision

To become the local partner of choice for active investors in Kuwait. Both for management and shareholders

We “Seed and Lead”, with our strategic and financial partners, we grow the business and enhance the shareholding structure of our equity partners.

Combining both sell side and buy side experiences guarantees both deal sourcing, proper investment assessment, ability to raise co investments, as well as proper management of

exits.

We are not passive investors investing in undervalued opportunities .. WE UNLOCK THE VALUE AND CREATE THE OPPORTUNITY.

Brand DNA

Moving forward

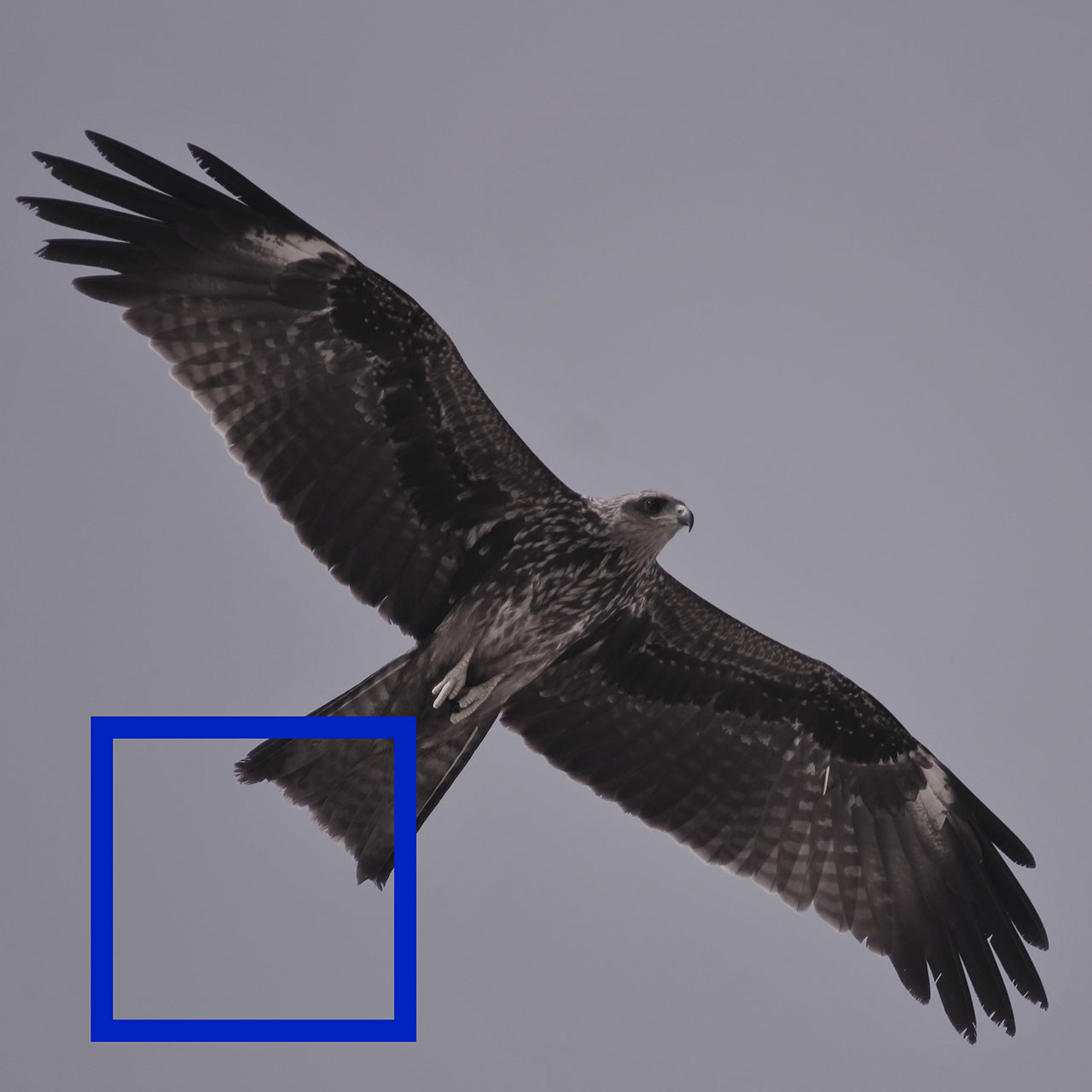

The Peregrine falcon is the fastest bird in the world ; its speed reflects the Unicap International Investment Consultant Finance Ltd ethos.

Blue square

The blue square symbolizes trust & strength. The orange accent adds confidence.

The falcon wing

emphasize Act Financial’s ability to seize opportunities that are out of competitors’ reach.

Act

take action – take steps – take measures – take the initiative – move forward – move fast

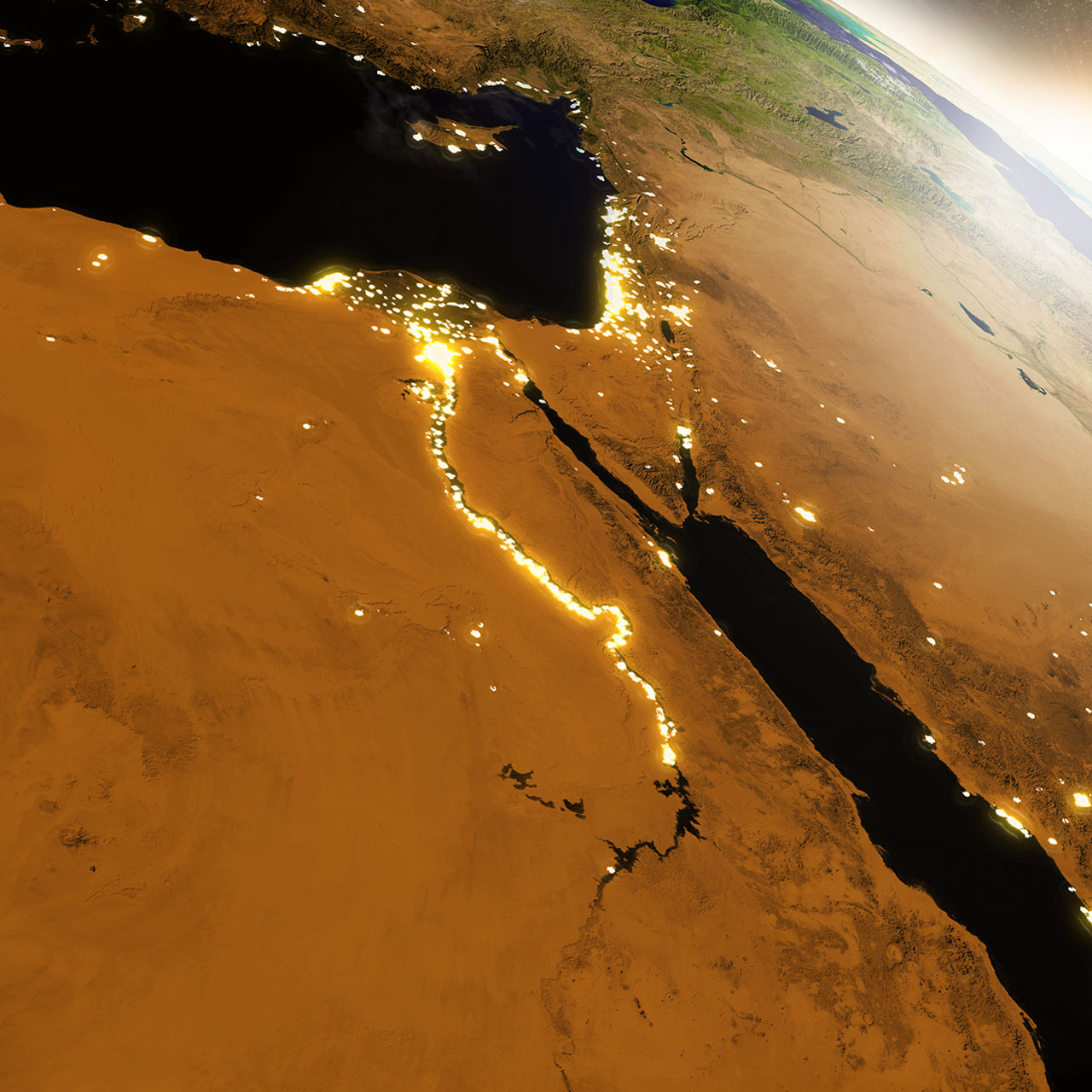

Investment Overview

Unicap International Investment Consultant Finance Ltd focuses mainly on equity investing in different shapes including buyouts, leveraged acquisitions, and multiple forms of liquid and illiquid investments:

- PIPEs: Private Investments in Public Equities, where we seed and lead co-investments in decent minorities in listed companies as well as managing buyouts and turnarounds

- Private Equity: Depending on the cycle of the market Act will always seek to have investment opportunities among the public and the private markets. We invest in multiple sectors regardless of the stage and age of the company, with focus on scalability, high growth and relevant proxy to the economy

- Pre IPOs: As anchor investor and corner stone participant, Unicap International Investment Consultant Finance Ltd, can start building PIPE positions before listing, and capitalizing on the team’s capital market’s experience, it helps in the completion of the successful listing process as well

Act is currently building also a debt Financing platform where it will be able not only to partner as equity holder with successful investments, but rather provide multiple creative, customized and engineered structures and solutions for companies in need of funding.

- An investment management company

- Placement expertise

- Market Environment and the Opportunity

- Focused on absolute return

- We invest our own money

- Versatile Setup

- Team harmony

- Converting from Advisory to Investing

Act has ambitious capital growth plans while maintaining a cost-efficient small setup. We believe that quality pays off over scale in investment companies.

A key factor to success is the ability to source investors and raise funding whenever is needed. Placement has always been an area of expertise for the team and should significantly help in growing the company.

The void of local investment managers that happened in the PE universe is currently replaced by the international players with generic experience across emerging markets in general. However, there is a clear vacuum of professionals who speak the language, know the business environment, and have spent long enough time in the local market with the right understanding of the culture and the system.

Whether it is a listed investment or a private investment, target return on the opportunity is our drive. We also always take time into our consideration; where we favor liquidity and quick scalability

The management team is fully invested in the setup and are investing their own money. Act is also built over the concept of seeding all its investments with co- investors to constantly align the interest.

We believe that environments are dynamic and the ability to timely adapt is key for success. So hovering between the stock market and the private investment universe is key. Also, adjusting the deal structures and exit plans are always key to remain dynamic with market conditions, cycles and trends.

The founders and management team share unmatched trust and harmony where they crossed over many years and teamed up for investments. The firm’s multi- disciplinary team has a long and successful track record of generating attractive investment returns having successfully executed numerous transactions requiring capital flexibility, financial restructuring, and operational turnaround not only on the buy side but also on the sell side.

The founders of Act have decided to move from the advisory business to directly own the investments out of their belief and conviction of the existence of the opportunity.

Investment Philosophy

Kuwait Centric

Unicap International Investment Consultant Finance Ltd is an Kuwait centric investment company with a full conviction in the never-ending Kuwait’s story and capitalizing on the team’s experience in understating the local dynamics

Out of the Box

We love structuring and creating opportunities through constantly thinking out of the box to design the investment and the space and create the unique exposure

Selection

We follow a detailed buy-side investment approach and a detailed selection process looking for ripe investment potentials with high conviction to find the right investment vehicle

Tactics

We believe that structure and tactics are crucial to unlock value, both hidden intrinsic value in the investment, as well as the value creation that we add to the equity story

Standards

The process is managed in a way similar to a pit stop on the fast track of a good engine racing vehicle. high Corporate Governance standards secures and guarantees safety of the trip

High Returns

And as much as we value the selection, the creativity of structuring, and the tactics to unlock value, we are also believers that translation of this into realizing high returns and timely exits are the name of the game

Investment Process

Deal Sourcing

Based on the team experience, and the scarcity of active money managers in Kuwait, Unicap International Investment Consultant Finance Ltd has an unmatched access to deal flow in different sectors and investment types and shapes. Be it listed on the exchange or on the private universe.